Want to See ONLY What You’re Looking For? Use Search on MyHouseDeals

In February 2017, we were excited to announce a new type of property on MyHouseDeals: investor-ready foreclosures. And now that we have more properties than ever, there is a bigger-than-ever need for SEARCH.

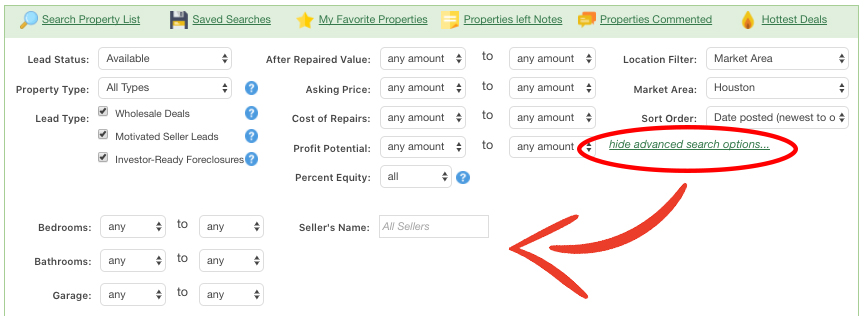

Even though it’s right at the top of the property list page, we realized a lot of members don’t know how to use this fancy feature! So…let’s go over all of the ways you can narrow down your search parameters so you’re only seeing what you WANT to see.

Ready?

Information Bar

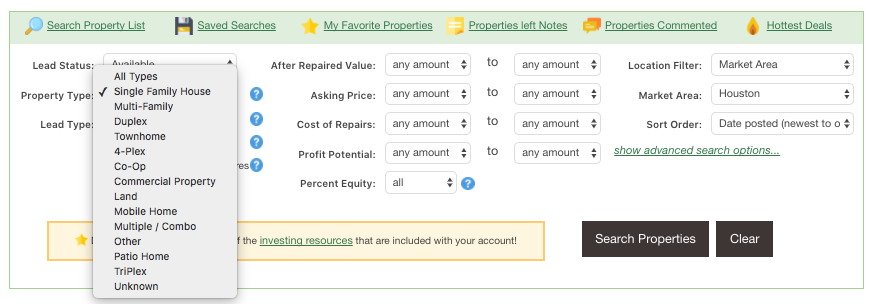

This green bar indicates the start of the search parameters, and also contains some handy features.

Search Properties (Show or Hide): You can minimize or reopen the search feature by clicking “Search Property List.”

Saved Searches: You can also save a search you perform instead of re-selecting your parameters every time you go to the site.

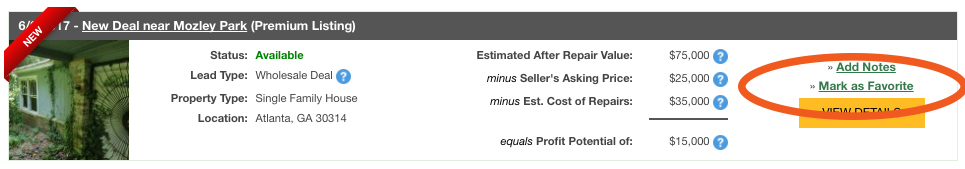

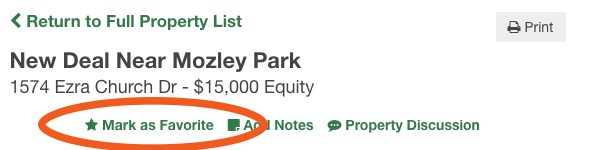

Favorite Properties: Next, you’ll see a link to “My Favorite Properties”. There are two places you can mark a property as a favorite.

- First, look to the right of the property details on the property list page.

- Secondly, once you’re on an individual property page, you can select a property as a favorite by selecting “Mark as Favorite” below the property title (near the top of the page).

Notes and Comments: Next, you’ll see two links labeled “Properties Left Notes” and “Properties Commented”. These links are where you’ll see any notes you’ve made about properties on the property details pages, OR any comments on properties made publicly for the wholesaler or public to view.

After the green bar, it’s starts getting serious. This is where you’ll spend the bulk of your time narrowing down search.

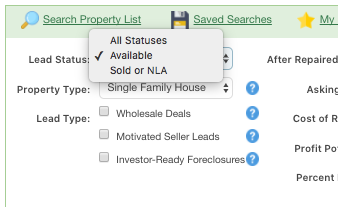

Lead Status

Under “Status,” you’ll see 3 options:

Most of the time, you’ll want to look at the available properties. But, if you’re looking for something that was sold or NLA (no longer listed), you can select to view all properties, sold, or NLA.

Property Type

Under “Property Type”, you’ll find a long list of the different types of properties posted on MyHouseDeals. The most common type of properties are single family homes, but investors post a wide range of deals on the site.

Lead Type

The title “lead type” refers to how the properties are sourced.

Motivated seller leads come directly from the homeowner who is especially motivated to sell their property.

Motivated sellers (pre-foreclosures) can also make for prime investment property. Like wholesale properties, these properties typically aren’t listed on the MLS. Instead of reaching out to a Realtor, these sellers want to work with directly with a buyer who can buy quickly, and that type of buyer is often an investor. If a deal is made, the motivated seller benefits by getting out from under their mortgage. The investor benefits by picking up an investment property at a significant discount.

Wholesale deals are posted by investors who have a contract with a motivated seller.

Wholesale properties are investment properties that are sold by other investors. The sellers are typically looking to make quick cash by selling you a fixer upper “as is.” You can often make the larger profit by buying, repairing, and reselling or renting the property. This type of property is not available on the MLS or other public sources.

Investor-ready foreclosures are properties we’ve gathered through information partners.

Investor-ready foreclosures are not your typical foreclosures. These properties weren’t purchased at foreclosure auction, and are now bank-owned, similar to REOs. MyHouseDeals helps you avoid the auctions and competition by compiling a list of all these properties and filtering out the ones that do not have room for profit, so you only see the good deals that are for sale at a significant discount. That’s what makes them investor-ready.

Special Notes About Investor-ready Foreclosures

Investor-ready foreclosures are the newest type of lead type offered on MyHouseDeals.

We’ve been working for months on partnerships that allow us to source these properties for our investors, but there are some special things you should note about these deals.

Here are some tips when accessing investor-ready foreclosures:

- The banks or sellers you’re calling mostly likely WON’T be familiar with MyHouseDeals, so when you call, it’s best to mention that you’re looking for information, rather than opening with, “I saw your property on MyHouseDeals…”

- Because investor-ready foreclosures are bank-owned, the sellers more easily negotiate on the price to recoup some of their losses. So while the equity spread on these deals may be smaller, and the repair needs less accurate, it’s still a good idea to call and get more information if there is a property that could fit your criteria.

- Because investor-ready foreclosures are bank-owned, the process for purchasing them often differs from bank to bank. We’ve had members and staff encounter very straight forward deals, and others say that the seller needed them to create a account on a third-party site. This shouldn’t deter you, but keep this in mind when reaching out.

The Numbers

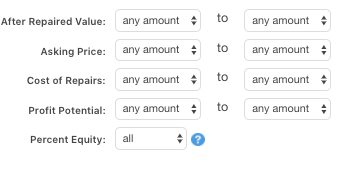

The next column in the search box all has to do with the numbers of the deal. I’m guessing that newbies and oldies alike are familiar with these terms, but let’s go over them for good measure.

After repair value: This refers to what the property can sell for at full price after renovations. In other words, the fixed-up value. This is an important number to know because it determines the most you’ll be able to sell the house for.

Many investors only want to buy properties within a certain ARV range. Higher ARV’s and higher end houses may have potential for greater rewards, but can also come with bigger risks.

Always pull your own comps and do your own due diligence. Wholesalers will tend to use the best comps in the area to determine the ARV, but you’ll want to research the ARV based on your personal exit strategy and plans for the house.

Asking price: This is how much the investor-seller (wholesaler) is selling the property for. If you know you can only qualify for a certain amount of financing, then you’ll want to refine your search by asking price.

Cost of repairs: This is the wholesaler’s estimate of how much it will cost to fix up the house.

Keep in mind, these estimates vary widely from what YOU think needs to be repairs, what the wholesaler thinks, or from what a professional inspector determines. It’s always best to visit the house, and do your own due diligence.

Profit potential: The profit potential is the ARV minus the cost of repairs. This number is very straight forward subtraction. Your actual profit potential should include holding costs, closing costs, and any other typical fees included from purchase, to rehab to resale.

Percent equity: This is a calculation of the asking price divided by the ARV. Most lenders will only lend a certain percentage of the ARV, so this is an important number to investors.

Location, Market & Sort Order

Location filter: The location filter contains the most common ways people usually search for property location: zip code, street address, city, county and state.

Market Area: Market area refers to the designated market area. Historically, we determined what market we focused on and included a certain range of counties, zip codes, or radius from a primary area (for example, “Central Texas” included San Antonio, Austin, and other surrounding counties).

While we still use this manual method for determining market areas, we now start by utilizing Nielsen Media Research DMA’s. Nielsen Media Research defines a Designated Market Area (DMA) as, “an exclusive geographic area of counties in which the home market television stations hold a dominance of total hours viewed. Most DMA’s are identical to MyHouseDeals market areas.

Advanced Options

Lastly, click “Show Advanced Search Options” to reveal additional options for searching. Bedroom, bathroom and garage are self explanatory.

The “Seller’s Name” category refers to the wholesaler, motivated seller or representative (in the case of investor-ready foreclosures) selling the property.

Now what?

The next step is for you to start viewing properties and deciding how you want to search, and what you’re searching for.

What else would you like to be able to search for? What is missing from the search page? Make sure to let us know in the comments!