Jay Goes from Odd Jobs to Funding His Own Deals

Jay Patel is a full-time real estate investor who’s found success with both flips and rentals. He has completed two deals using MyHouseDeals.com and shares his insight on how to build portfolio of investment properties.

He has experience raising money from private lenders and has now reached the point where he can fund his own deals. He’s never had a mentor but learned through trial and error. Learn from Mr. Patel’s successes and failures.

Read on to find out:

- The complications with raising money from friends and family

- Advice on building a team and networking

- How becoming a real estate agent helped him market deals

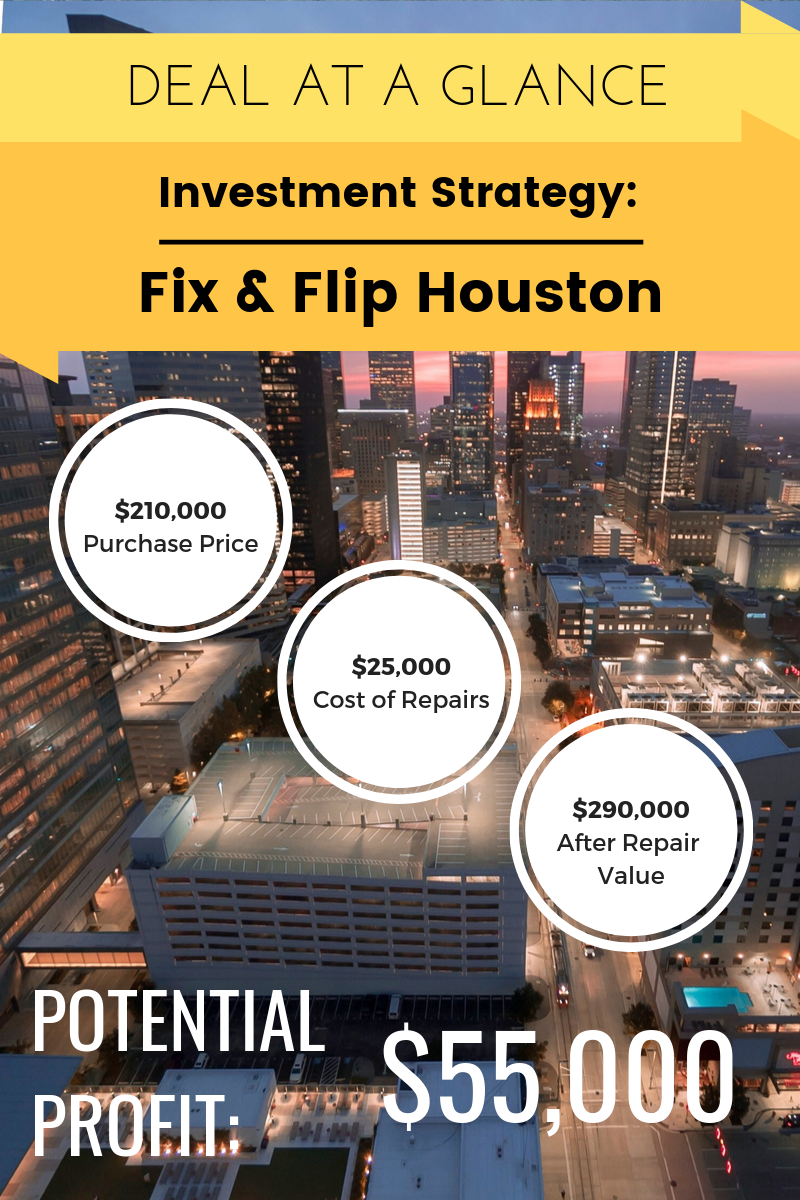

The below graphic shows a summary of the deal he found on MyHouseDeals.

Listen to the audio of the full interview here:

MyHouseDeals.com Success Stories

What made you interested in real estate investing?

Freedom of time. Of course there’s money too.

Would you consider yourself a part-time or a full-time real estate investor at this time?

I’m full-time now.

How were you able to transition into full-time real estate?

I was working odd jobs and not making enough money so that led me to try real estate. I read a little bit about investing, and that’s how it started.

It’s been for four plus years. Now I am a full-time investor.

How did you build up your knowledge in real estate investing?

I attended a nearby club called Wealth Club and talked to a lot of people. Basically I networked and that’s how I learned.

Did you have a mentor?

No, I just learned by doing. I bought the property and then on the other side I talked to the people in my network. I talked to the contractor. I talked to the lender. And that’s how I learned.

What was the biggest mistake you’ve made in your real estate investing business so far?

Yeah, I’ve learned so many lessons actually. I’ve learned by making mistakes. If I don’t pay a mentor, I have to pay somehow, you know? I learned by experience.

Why do you think you were able to succeed while other investors struggle?

I didn’t repeat the same mistake and I always kept everybody happy. By keeping everyone happy, I was able to make a strong team.

If I buy another property, I won’t have to look far for people. Building a team is what has made me successful.

So basically you find experts and rely on them?

Yes, in this way you can make your own system, follow that system and learn more by networking. Ask people questions and they’re actually happy to help.

How have you been able to develop your marketing and business skill sets since you began investing?

Over a year ago I got my license as a Realtor and now I work with Keller Williams now.

Initially I had challenges marketing properties. I bought so many offloaded properties and I got stuck with some of them. I had a hard time selling them and a hard time marketing them.

Then I got my license and got connected to Keller Williams. That’s how I developed my knowledge for marketing properties and how it works. Once I got a handle of marketing I began to succeed.

When buying from a wholesaler or a motivated seller, how do you convince them that you’re a serious buyer?

I don’t usually buy directly from motivated sellers. Most of the time I depend on lists of wholesalers and I use my MyHouseDeals. This is my second property from MyHouseDeals.com.

In very few cases I have talked to sellers. Like everybody says, pay attention to their need for selling. Follow their needs and you’re good.

So what is your current strategy, do you find buyers first or properties first?

I just look for good deals where I can make money. I work with other investors who can help finance my deals.

I start with finding the deal. Once I’ve made the calculations, I put some of my own money and I show the investors that, “Hey, I have some investment into this. Would you like to invest?” I’m talking two years back. That’s what I used to do.

Now I have the money to invest on my own. With properties around $200k-$250k I can fund them myself. Once the rehab is finished and it’s on the market, I start looking for the next property. Meanwhile, the first one gets sold and I am ready to buy the second one. That’s how I work.

Nowadays I’ve slowed down a bit. Before, I did so many, but now I’ve slowed to maybe six to eight good deals in a year.

Can you take us through your experience with the deal you found on MyHouseDeals?

I was looking for a property where I could profit between $30k-$40k. This property was from a wholesaler. He was good enough to provide accurate numbers. He had his homework done.

The sale price was $210k and the rehab was quoted at $30k. And that’s exactly how it ended up. I bought it for $210k and I put $30k into it. I have not calculated the ARV yet, but the appraisal is $290k.

It should be a good deal for me. Next week it will go on the market. We just need to cleanup and we’ll be good to go.

What was your strategy on negotiating the price?

First I compared it to other homes. Then I had to decide the strategy whether to buy and hold or to flip it. Accordingly, I did the numbers and I decided to flip it since it was far from my home.

I usually do business within three miles of my home. This one is 12 miles away. Since my goal was to flip the property, I started negotiating with the wholesaler. There wasn’t much room to negotiate, but he was reasonable enough to come down a bit.

Were there any hurdles that you faced when closing the deal or did it go smoothly?

Yeah, it went smoothly. There weren’t any big hurdles because most of the work was already done. It was a foreclosed property and most of the work was done by the wholesaler.

He also had his own title company. I did have some challenges with that company. But with some patience the deal happened and we closed the property.

Did you finance this deal with private investors or did you do this one yourself?

I funded this one myself.

In the past with private investors, how did you approach them?

Initially I actually used money from friends and family. One time I got stuck on a deal with a family member who was not a professional lender. In cases like that people get scared and decide, “Oh Jay, I need my money back right away.”

So I had to give it back and borrow money from a private lender. She was nice enough to lend me the money, but I had to pay the price because I didn’t know how private lending works. I had never borrowed money from professionals before.

The terms were for six months and it went over six months. I could not sell my home. For that particular property, I could not sell so I could not get her money back. So she said, “Okay, just hand over your property and I’ll let you go.”

So you’ve found a big difference borrowing from friends and family vs professionals?

Yes, with friends or relatives, they are not professionals. Just make the picture clear to them what’s going to happen. “I might not be able to give your money in six months. How about eight month or nine months? It might take one year. What would you do in that situation?” It’s important to talk to them upfront so everyone ends up happy.

Do you have any advice for new real estate investors looking to get started in wholesaling or flipping?

No advice. Just take action. When you take action, people look at the action first. Take action so people are ready to help you.

If you are just attending the seminars or attending the clubs and not investing, you can be seen as wasting people’s time. People will look at either your time commitment or financial commitment. If you are committed and taking action, then they are ready to help you.

Let them know that you are attending the events and you are about to take action. If you don’t have money, just show your commitment and try to gain knowledge. Answer their questions, whatever their questions are and they may be ready to finance you. Be ready to take action. That’s what I advise.

You’ve given some great advice, so thank you again for sharing your knowledge and your feedback on the real estate investing industry.

Thank you guys too. MyHouseDeals.com really helps investors like me. It’s a very low subscription and you get a wealth of information. Actually, your website has everything one needs as an investor. The newcomer needs everything your website has, so thank you so much.