Private Money Lenders: The Definitive Guide

Being in the real estate investing business takes effort. Whether you’re greener than green brand-new, or a seasoned, savvy investor, money is a requirement. Having the capital to invest in a property isn’t always easy to come by yourself. That’s where private money lenders come in handy. Private lenders for real estate can be anywhere, but you need to know where to look, and you need to know how to handle the funding process properly.

MyHouseDeals has been working to match members of our tribe with lenders for a while now, and recently we’ve optimized our process to do so.

Keep reading to find out the best practices in how to find and work with private lenders.

Who Are Private Money Lenders?

Simply put, private lenders are individuals who are willing to fund real estate investment deals of other individuals or entities. The primary characteristic of a private lender is that they are not tied to a financial institution. Private lenders are everywhere, and they can be anyone.

Private lenders can be family members or friends, they can be business connections, or they can be a stranger you meet through a networking event like your local REIA meeting. For investors just starting out, convincing someone in your close circle to invest in your property deal can be easier than reaching out to a stranger.

Why Partner with Private Lenders?

Private money lenders have become an increasingly popular source for investors to find funding for their deals. For investors with a lucrative deal, it’s necessary to find the cash as quickly as possible. Banks, while an option, can take longer than one might have the time for.

Not only that, the terms and conditions can number up to the hundreds, and even then, a bank won’t guarantee you funding. This could be for a variety of reasons, such as the property being deemed too damaged, too old, or the bank just might not see the same potential for profit as you do. Banks also require a credit score, and if you do get approved, the process could take weeks and weeks.

Investors naturally then seek other means of funding, and private lenders are the perfect answer. How much money you get from a lender depends on a variety of factors. If you’re new to investing, a lender might not want to fund 100% of the deal. If you have a diverse portfolio and are a seasoned investor, the lender might fund 100%, but ultimately, how much the private lender gives you is up to them. There are also other arrangements that are possible—it’s all up for negotiation.

Partnering with a private lender helps an investor mitigate his or her own risk. And if done successfully, will help any investor grow their business and profit. If you’re able to buy more properties with lender support, then you have more opportunities to make more profits. And more quickly.

Making a Perfect Private Lender Match

Private money lenders can be found everywhere, and therefore it can be intimidating for new investors to know where to start. Networking can help, but MyHouseDeals tries to make the process easier for members of our tribe.

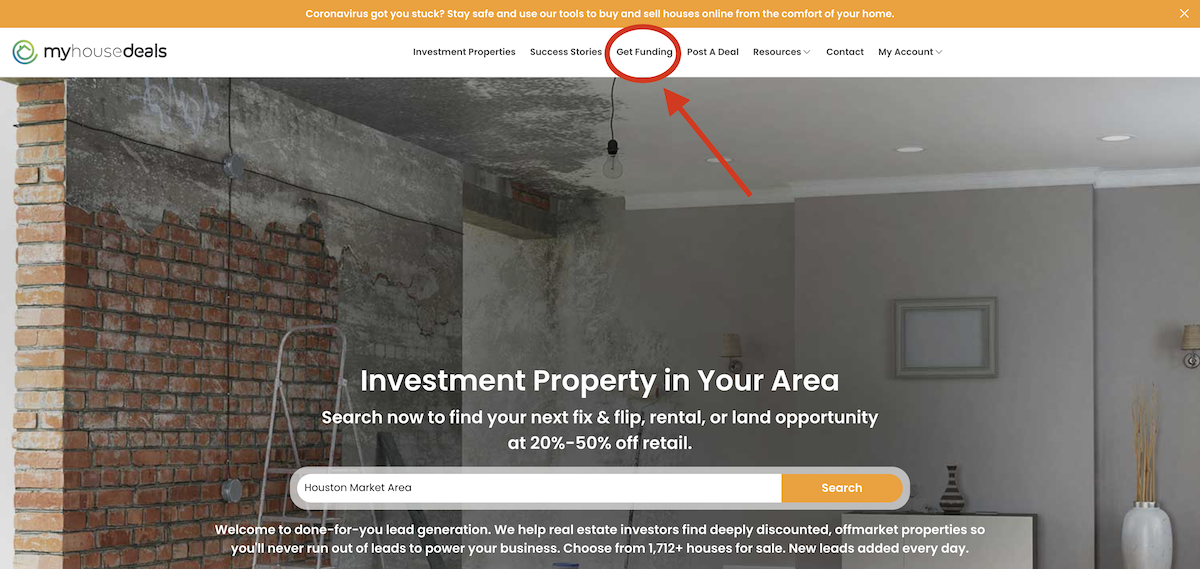

One feature that MyHouseDeals has offered to our members is the option to get funding, and recently, we’ve streamlined this process. On our home page, you’ll notice an option that says “Get Funding.”

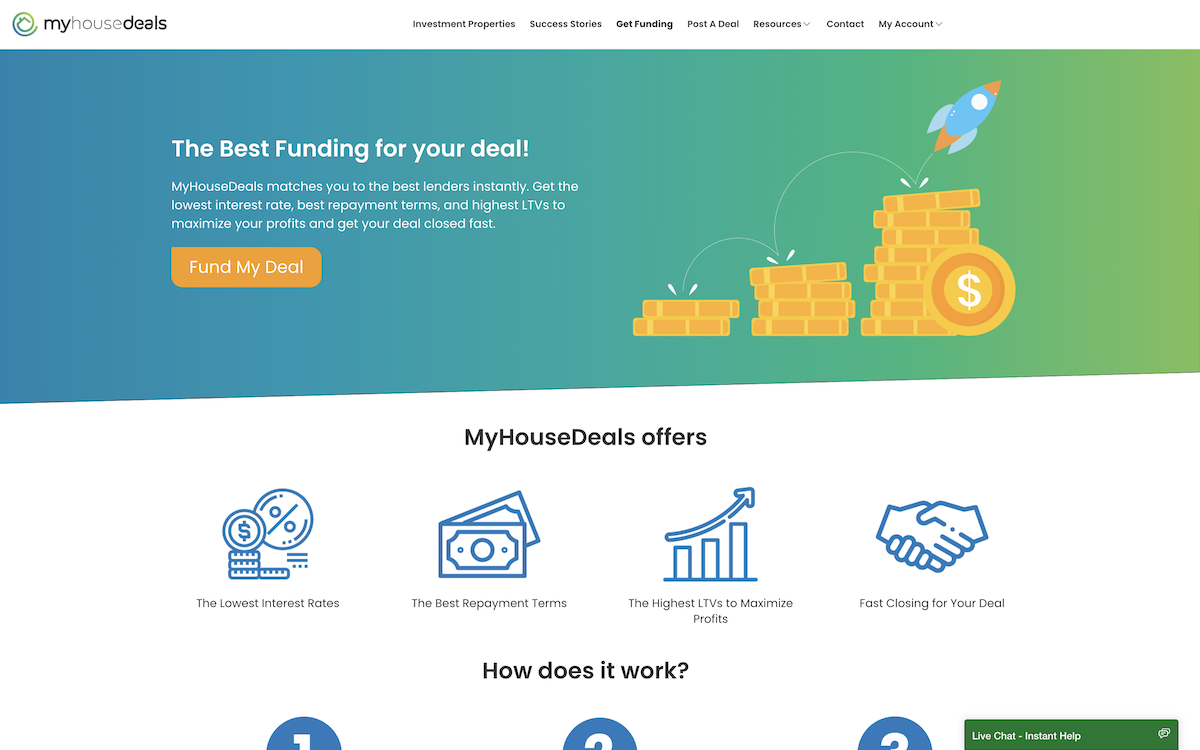

It will take you to our funding page for you to start the process.

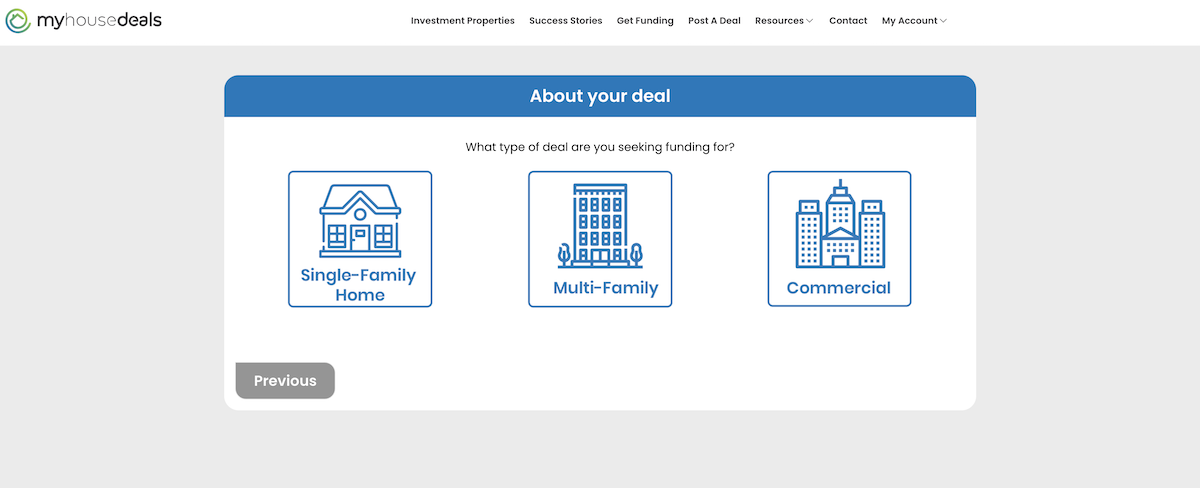

As you go through this new, optimized process, you’ll be asked what type of property you have. . .

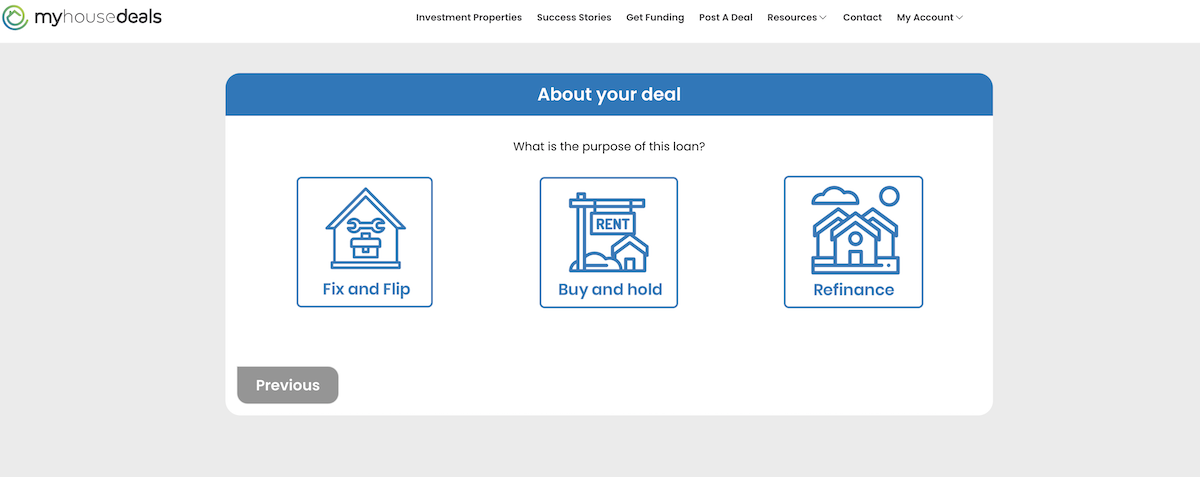

What you intend to do with the property. . .

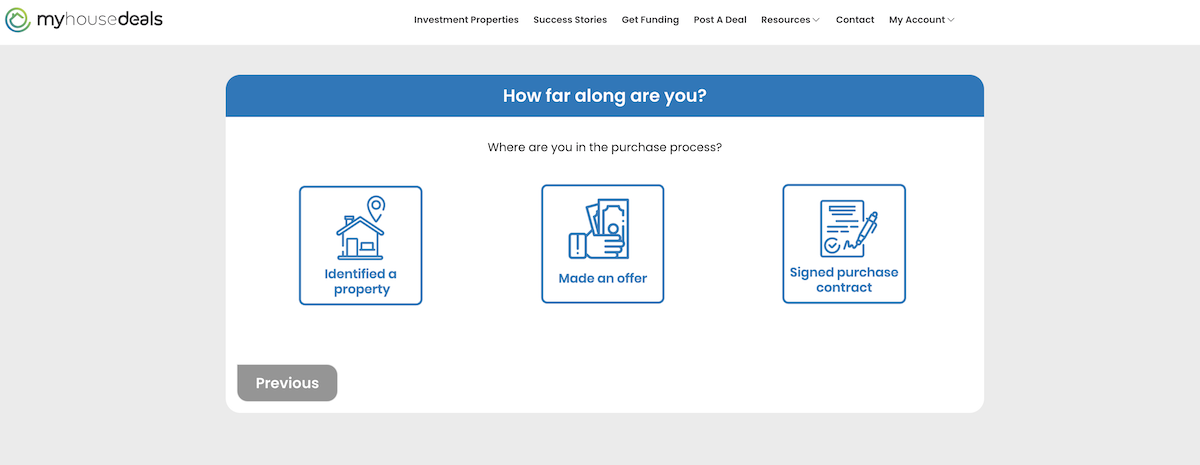

And how far along in the purchase process you are. We should point out that to fully utilize the “Get Funding” feature, you need to have at least identified a property that you’re interested in purchasing.

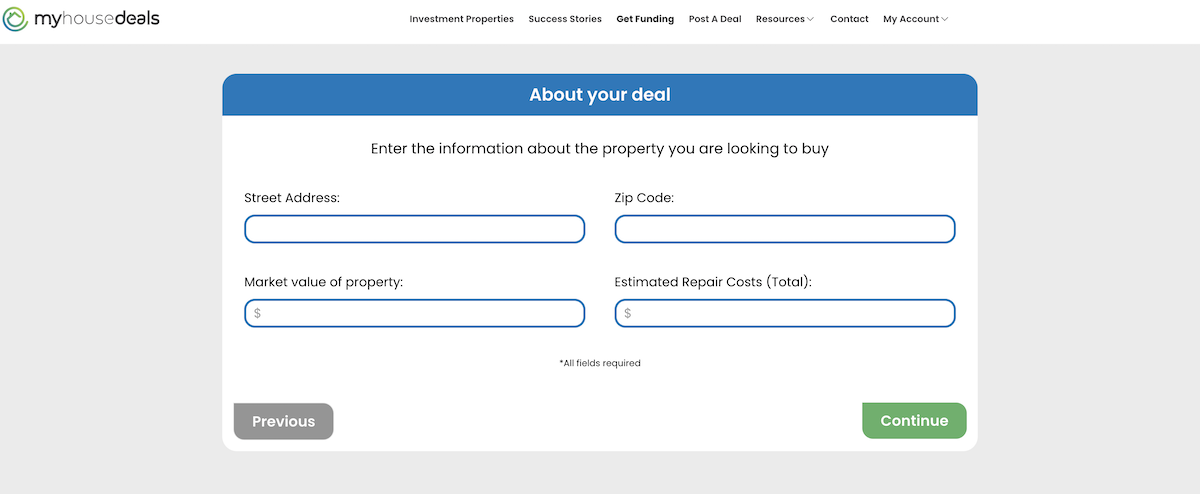

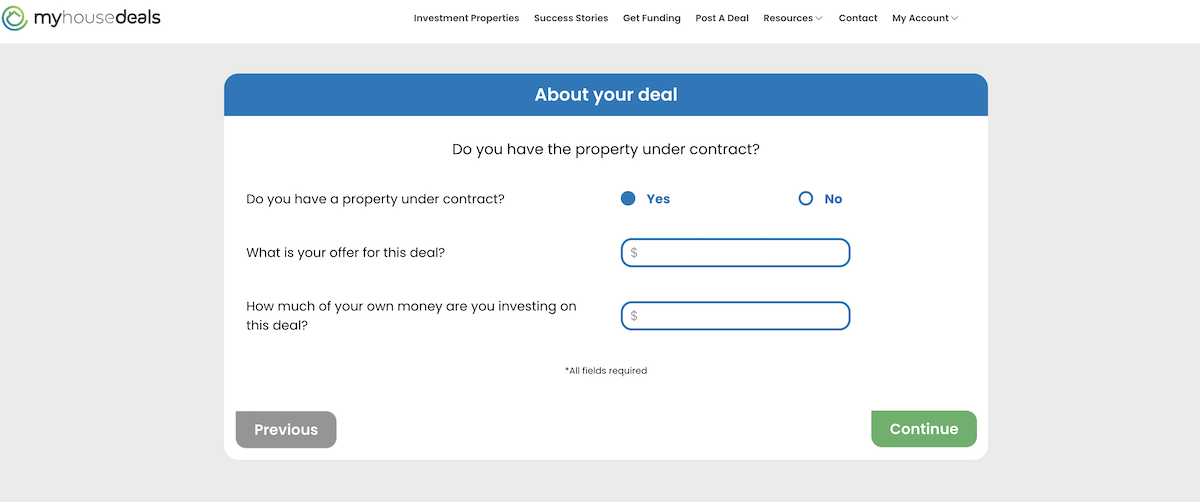

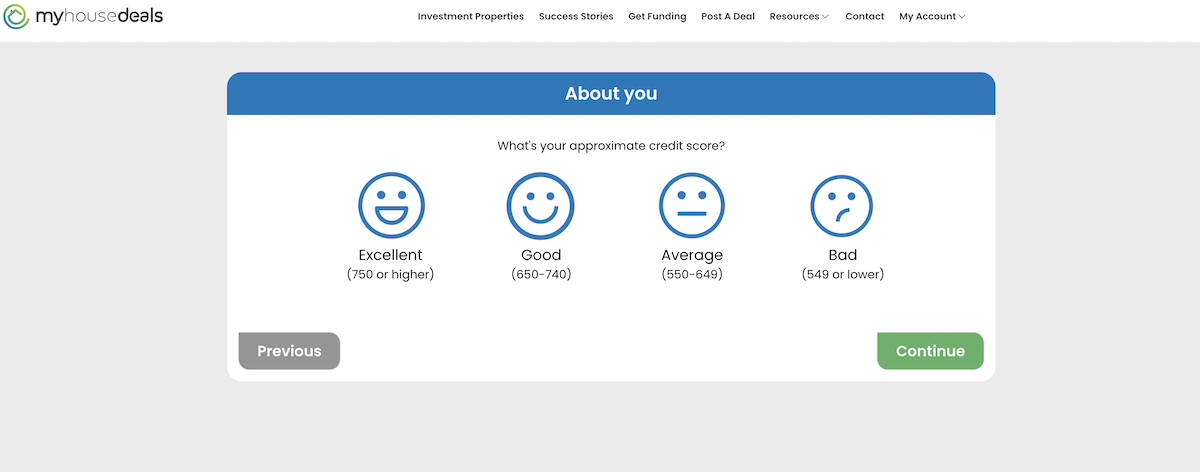

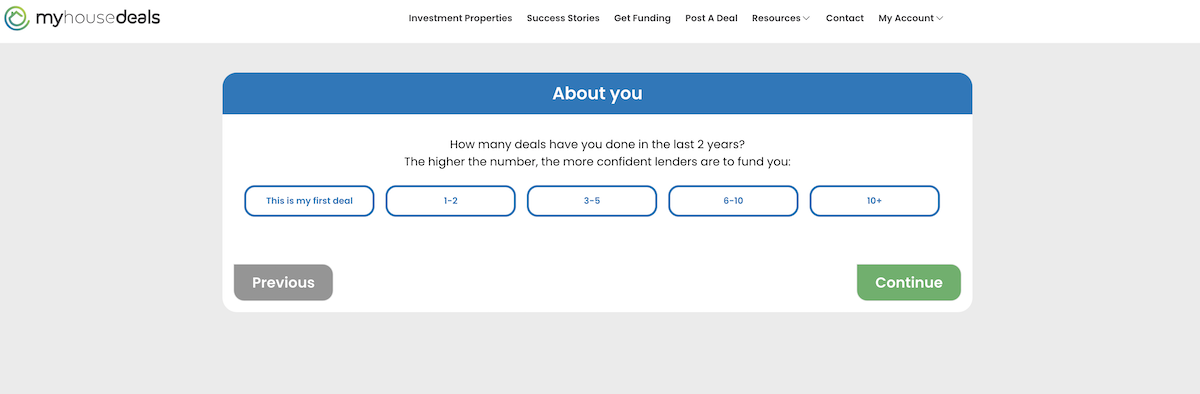

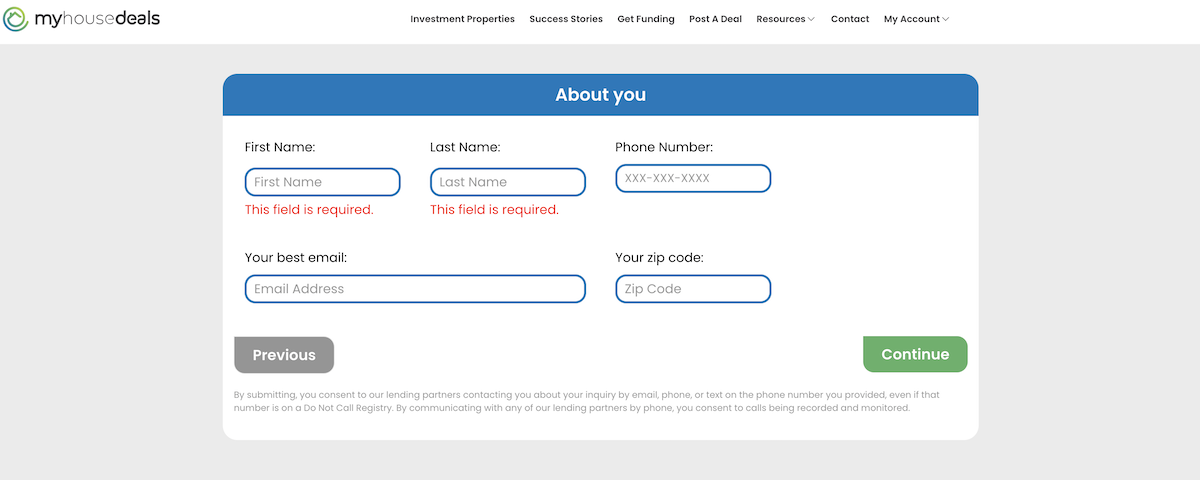

From there, you’ll fill out some information and we’ll do our best to play matchmaker and connect you with a private lender who’s looking to fund a deal! This is just one way for investors to find a private lender, and it’s one we highly encourage you to try.

However you end up finding your lender, whether through our site or networking or even if it’s just a family member or friend willing to help, there are certain things you need to know.

Private Lenders: The Foundation

So you’ve found a private lender. Now what? You’d think the first thing to do would be to start talking about the money, right?

Not quite.

Every savvy real estate investor knows that the relationship you have with your private lender is exactly that: a relationship. Both of you are interested in a deal, yes, but talking about money right out of the gate can sometimes do more harm than good.

If you’re a new investor, with a minimal portfolio, your lender might be interested in the deal, but you might need to do some convincing. Lenders are people, so take the time to get to know them.

Ask questions such as:

- What are your goals with this property?

- What are your terms for lending?

- What is your experience with lending?

Getting to know your lender is crucial to making the partnership work. And if they’re a first-time lender, and you’re a seasoned investor, then it’s your job to educate them with the proper knowledge on how the world of real estate investing works.

Trust One Another

Establishing trust with your lender should be one of your top priorities when you first meet with them.

Lenders have built up their capital in various ways, but no matter what, it’s still a precious resource that needs to be handled with care. That’s why investors need to build that relationship with their lenders. Give them a reason to trust you.

There are many ways this can happen, such as referencing your diverse portfolio of successful deals. It could be your work ethic and timely repayment. If you’re new, it could be your dedication and complete confidence your deal is going to work out.

We’d also like to reassure new investors that just because you’re new, that doesn’t mean you won’t get the funding. Experienced lenders will need to see your worth, so know what you’re talking about. Exhibiting competence will win over a lender.

Whatever the case, we can’t stress enough that building trust with your lender is extremely important. The mindset of building that relationship will make you that much more successful in the long run.

We do recommend caution, however. This is a working relationship, after all. Ensuring success to the best of your ability helps secure this relationship. Broken trust could lead to you losing your relationship with your lender. And if you are still paying back their loan, be aware there could be legal ramifications.

Teamwork Makes the Dream Work

Like most things, finding the right lender will take some time. How you approach the lender is the make or break moment, however. Remember that this is a relationship, that your lender is a person just like you. They need you, and you need them so make it a win-win.

Establishing goals and trust with your lender will aid you in the long run. If it all works out, then this lender could be a lifelong partner that you do many deals with.

If you’re apprehensive about a private lender, be it not knowing where to find them, or not knowing enough about private lenders, don’t worry. MyHouseDeals has an easy-to-use get funding funnel for you to use that does the legwork for you.

Not only that, but we can teach you how to navigate the world of private money lenders. PrivateMoneyMastery.com is a training program that teaches investors everything they need to know about private money. You’ll learn the basics of what private money is, how to raise it, where to find private lenders, how you should approach them, and more. And more importantly, how to get private money lenders to continue to invest in your deals so that you never have to worry about funding again.

Happy, and profitable, investing!