Glen Shares His Real Estate Knowledge After 21 Years of Investing

Glen Glasper has been investing in flips, wholesale and buy & hold properties for more than two decades, and now as a mentor he shares his real estate knowledge with new investors.

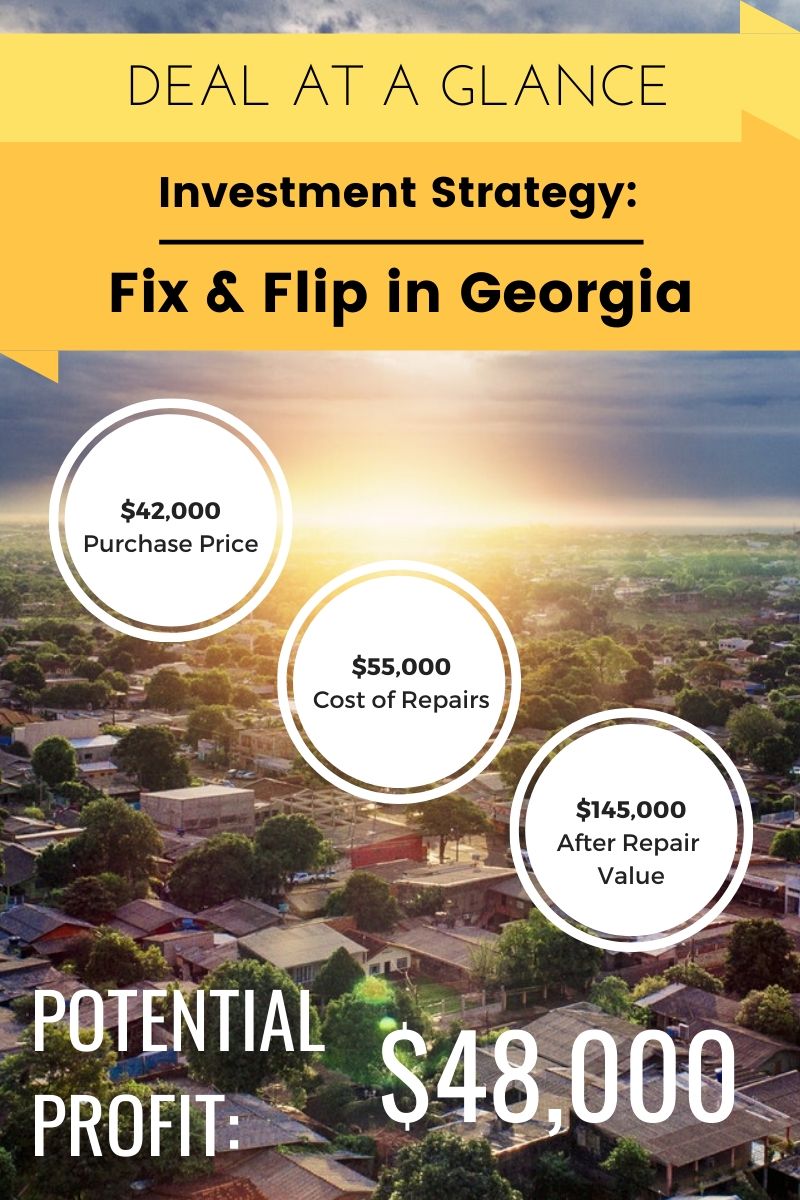

In general, he mostly focuses on buy and hold properties and encourages his students to do the same. The deal he found on MyHouseDeals was actually a fix and flip purchased for $42k, with $55k in needed repairs and an ARV of $145k.

In this interview we discuss:

- How he learned to invest

- Ways he prevents mistakes

- Advice for new investors

The below graphic shows a summary of the deal (click to find your own deal):

Click above to hear the audio of our interview with Glen

What sparked your interest in real estate investing?

A commercial that I saw on TV about 21 years ago. It was intriguing the way they presented it. It was almost as if they were saying that even a caveman can do it. I was sort of living in a cave at the time, so I figured I might give it a try. It was more so just an opportunity to be able to generate income and have ownership.

How else did you build up your real estate knowledge?

Well, honestly, back in those times, I don’t recall there being a local real estate investor meeting. What I did was I bought a course online and that course gave me my initial real estate knowledge.

Did you find it difficult to start once you obtained the knowledge?

Actually, no, not once I began to understand what I was actually learning. It was kind of a learning curve because initially when I got started I did not have a mentor.

And once I got the help of a mentor, who was also a real estate attorney, it actually helped me get my first deal closed. After closing that deal, I became more intrigued, and began to see myself making a career of it.

Once you began working with your mentor, did you find that everything moved pretty smoothly?

Before my first deal, one of the things that I learned in the course was to put together what they call a power team. As part of that power team, I sought out the real estate attorney.

I didn’t think of seeking out a mentor and the real estate attorney might not have considered himself as a mentor of mine, but looking back on it now, I consider him to be one of my first actual mentors. After he saw what I learned from the course, he saw that there was potential in me, so he decided to help me get my first deal closed.

There was a little bit of hesitation doing my first deal until I actually met him and he helped me understand how much simpler the process can be, you know, as opposed to overcomplicating it, which I was probably going to do by myself.

In your experience with investing, do you feel a lot of beginners overcomplicate the process?

All the time, and I think it’s because of the lack of understanding of the process. I think in our real estate investing world today, and specifically with wholesaling, a lot of people are being taught that you can do this with little or no money, or little or no credit, and you don’t basically have to have anything.

And when they find out that that’s not 100% true. I think that’s when they go into information overload and they’re still trying to look for that aha moment where they actually can do it with no money or no credit. Like I say, it’s possible, but it’s not 100% true. It’s about 95% true if you don’t overcomplicate things. But many times people will overcomplicate it and that’s where they get caught in the trap of information overload.

What I teach many of my students is, it’s not that difficult once you grasp the knowledge and grasp the understanding. You can have a lot of knowledge about it, but if you don’t truly understand it, then that’s what’s going to make it a little more difficult.

What is your biggest mistake as an investor and what did you learn from it?

My biggest mistake that I’ve made in real estate investing is not documenting everything. That’s in any situation, you know, documenting agreements between myself and sellers, myself and buyers, myself and even my students.

When you don’t document those things, especially in situations where there are large amounts of money being transacted, people tend to get a little bit of an amnesia initially. So you know, when you document things, it’s easier to go back to what was written in black and white.

Even if there was something that was said outside of that agreement, black and white still holds true to what actually should transpire. The biggest lesson learned, like I said, is it’s very important to have documentation because that beats conversation all day long.

How has this changed your career and affected your lifestyle now that you’re a full-time investor?

It has changed tremendously. I have been a full time real estate investor 21 years, and throughout that 21 years, I think I had a job maybe the first two years. In the last 19 years, it’s been freeing, to be able to have a bit more control of my time.

Do you invest more in fix & flip or buy & hold properties?

My strategy now is primarily buy and hold. I do have some students that are interested in fixing and flipping, but I’m even teaching them to go the way of buy and hold right now.

How have you developed professionally through both investing and teaching?

I don’t know if it’s a cliche way of saying it, but I learned a lot more by teaching. By teaching and having this as a profession of mine, I am always learning. I’m always a student. I’m a student first.

So even in my teaching, I teach things that I forgot that I even knew. So I’m reminded that we should always continue to be students of our craft or students of this business. Not only are things ever changing, but there are many cases that we don’t recall that we had knowledge of that are still applicable to a lot of what we’re doing today.

Take me through your experience with the deal you found on our site. What kind of property were you initially looking for?

I was actually looking for a property to fix and flip because that was my primary model at the time. I came across the deal and saw that the numbers worked, so I contacted the people that were selling it and we bought it, fixed it and sold it.

How did you pull those comps?

My wife’s an agent, which makes me a special agent. She was able to pull the comps and help with the due diligence and things like that.

Did you find the information to be reliable on the site in comparison to the data that you guys pull?

To a degree, I always tell my students trust through verification and sometimes when you do trust, verify again. The percentages for that particular deal were very close to what I was looking for.

I knew the people that were selling, and they were experienced people. I hadn’t done any business with them, but I was familiar with them, so I trusted their numbers. But of course I verified them and they were very close to what I had come to. So it was an easy deal to do.

What was your strategy as far as negotiating the price?

My strategy in negotiating is always to get as close to the 65% of the after repair value as possible. And I think that particular deal came in at about 67% which was a little bit high compared to what I would ordinarily do.

But the numbers worked out overall, since I was able to save on the rehab process. My strategy was always stay around 65% of the after repair value.

How did you finance this deal?

It was a hard money money deal.

Did you go through any hurdles when you went through the hard money lender vs a bank or a private lender?

My preference is always a private lender. Well, at least the ones that I’ve dealt with because they don’t make me jump through many hoops to get the deal done.

For the most part, with many of the hard money lenders that I deal with, there’s also not many hoops because of the relationships that I’ve developed with them, but there are still some challenges.

I think we took a little bit longer to close, but I expected it because of issues with their appraisal and things like that. There was just a little bit of delay in the closing. But other than that, the lender was spot on with the numbers we were looking for.

What advice would you give to new real estate investors?

First of all, seek a mentor. Study and always be a student. Be extremely coachable.

I say that because sometimes people study and they learn and they think they know it all, and then they realize that they don’t have all the knowledge they need.

Even after 21 years of being in the business now full-time, it’s ever changing on some front, so I’m always a student first.