How One MyHouseDeals Member Uses The Site

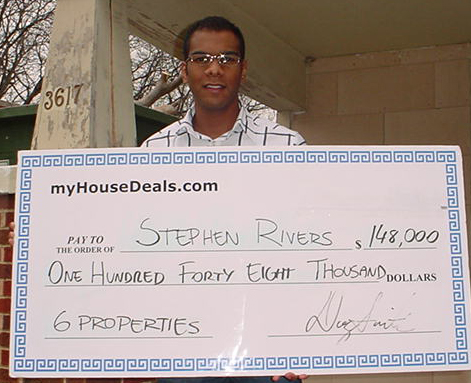

Doug: Stephen Rivers has purchased 12 properties since he began investing, and 8 of those have been wholesale deals from MyHouseDeals.com. He has sold 4 of those properties so far. Stephen could you give us a little bit of information about your background in real estate investing. What kind of experience do you have?

Stephen: I started as a Realtor and got my license when I was 18. Then I was always interested in investing and a partner of mine that was a long time friend, I recently sat across the desk from him and told him, “Joe I want to learn how to invest. Find me some properties.” So I began to look for some properties and I ran into myhousedeals.com. I showed him what I was looking at, he had the money, he showed me how to rehab homes, what to look out for and basically showed me the ropes.

Doug: Now from these 8 wholesale deals that you bought, you said that you sold 4 of them so far. About how much have you made per property that you’ve sold?

Stephen: On average $25,000.

Doug: What about the 4 that you still own? Do you plan to sell or lease them? And what kind of profit do you expect to make?

Stephen: We plan to sell those. The profit should be about the same amount, $20,000 to $25,000.

Doug: How would you say that myhousedeals.com has helped you get going with your real estate investing?

Stephen: Wow. It has really helped me because I don’t have to do a lot of leg work. I can just log onto the website and scroll through the deals and see what would work out for me. I’m not a full time investor at this point. I don’t have the time to go look out and scout, do mailings and knock on doors. So really myhousedeals.com has cut my time in half and made it very convenient for me. It also helped me network with other wholesalers. So really it helped me start off with a bang.

Doug: These properties that you bought, you mentioned they were all wholesale deals, so is that where you like to spend most of your time as opposed to the motivated seller leads?

Stephen: Yes, I’m looking at some of the motivated sellers and I’ve seen some good deals but it looks like sometimes someone would get there before I did so I’m mostly spending a lot more time at the wholesale deals.

Doug: Some people see one or two wholesale properties that someone has posted with an inflated after repair value or a low cost repairs. And they get frustrated by that and they either cancel their membership or they just switch over to the motivated sellers. How have you handled the fact that some of the after repair values and repair costs on the wholesale side aren’t always accurate?

Stephen: When I see that number of an estimated repair I take that with a grain of salt because everybody has their own crews and I can do repairs different or maybe even cheaper or better. So I keep in mind that I might have to up that price by 20% or discount it 20% and I go out there and look at the property and see how much I can fix it for.

Doug: About how many properties have you found that you need to look at in order to buy one?

Stephen: I think about 6 to 8.

Doug: Is that actually going and visiting and looking at them or is that just looking at the numbers on the computer?

Stephen: I go by the numbers on the computer. Usually when I’ve actually looked at a property on wholesale deals, I can look at the numbers and say okay they match pretty good and I’ll do my comps with an agent of mine before I even go out there. So I do my homework. I’ve looked at the property, pulled out the comps, look at the tax records and crunching my numbers to see if it works and then I’ll go out there and look. And usually every time I went out and looked, it’s usually a good deal.

Doug: Do you typically offer the wholesalers about what they’re asking price is or do you go in and try to negotiate?

Stephen: I usually try and negotiate.

Doug: How much have you found that you can get off the asking price?

Stephen: I guess that really depends on the wholesale dealer. Some of them have been really easy to work with and some of them have been really firm. I really couldn’t give you a number.

Doug: Do you remember what the most was that you were able to get them to come off their asking price?

Stephen: Right off the top of my head probably about $8,000.

Doug: I found that a lot of times wholesalers will post a deal with a high asaking price to see if somebody will bite. And most investors don’t bite, so it frees up room for somebody like like you to go in and make a lower offer and get the deal. Is that what you found to be true?

Stephen: Yes, definitely. I’ve never been intimidated. I always go in and try to find out. I just say hey we’re really interested in that property, we have the money. Can you work with me? Usually when you come with that attitude, you’ve got the money, you’ve got the backing, then usually they’ll work with you to try and get that property sold because they want the money as much as you do.

Doug: They sure do. Now what kinds of houses do you focus on? Is it the lower end, the higher end, mid range?

Stephen: Mid range, we’re looking for at least 1200 square feet and up, 3 bedrooms, 2 bath brick home, so probably mid range.

Doug: Those properties are nice to hold on to for the long term. Do you have plans to start holding these properties eventually or do you just plan to continue to fix and resell them?

Stephen: At this point, we’re just fixing up and reselling them but we are going to be holding here pretty soon.

Doug: Very good. Thanks so much Stephen. Keep up the good work!