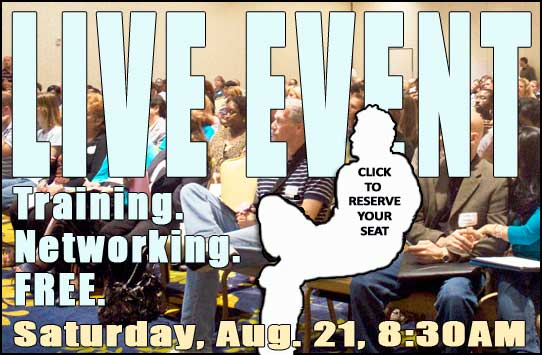

Have you registered for this Saturday’s Live Event?

Our next Live Event with Training and Networking happens in Houston this Saturday! You won’t want to miss it, so click the image below to reserve your spot (it’s free!)…

This is going to be another awesome opportunity for networking with other Houston investors and for learning about what’s working in real estate investing right now! We’ve arranged for two in-depth training sessions. They are…

Panel of Rehabbers & Landlords

In this session, our expert panel will share their most valuable tips and strategies for reaping big profits in the current market. They will also answer your questions directly during a lightning round of Q&A, so have your questions ready. Topics include:

– Where they’re finding their deals

– How they’re financing them

– How they’re keeping repair costs low

– How they’re STILL selling or renting quickly

We’ve assembled a panel of experts that can tackle these topics like no other. They are…

Eddie Gant |

Eddie is the owner of one of the largest home buying operations in all of Texas. Eddie has bought and sold over 400 houses. He also owns a mortgage company and a hard money company. In short, Eddie knows the real estate investment business inside and out. His specialty is rehabbing and re-selling properties for maximum profits. |

Glenn Dickson |

Glenn manages a portfolio of about 500 single-family homes and small apartments through his company, Complete Property Services. He is a past Board Member and Vice President of the Realty Investment Club of Houston (RICH), an investor, holds a real estate broker license, and has been in both residential and commercial real estate for about 18 years. |

Brant Phillips |

Brant bought his first investment property less than 3 years ago when he had almost no cash to his name. Since that time he has gone on to buy almost 50 properties, and he did this while working a corporate job and raising a family. Brant has since left his corporate job to pursue real estate investing and entrepreneurship full-time. In addition to his investing business, he owns and operates Rent Ready Contractors. |

What’s new in the world of lending? Market update for long-term loans for investors and end buyers presented by Roger Salinas of Zeus Mortgage. Find out…

– Current lending rates and where they are headed

– How to increase your chances of qualifying for a loan

– Recent legislation that directly affects real estate investors

– How to find the best financing option for your investments

|

|

Roger is a preferred lender for many of Houston’s most active investors. He has also given workshops, seminars, and bus tours on everything from mortgage basics to sophisticated purchase strategies. In 2009, Roger joined the Zeus Mortgage leadership team where he sets policy and provides coaching for the firm’s strategic objectives. He is also a founding member and volunteer for The Fanatical Change Foundation. Roger has been regularly featured on CNN radio, the Real Deal Radio Show, the Real Estate Uncensored Radio Show, Aztec television, and various other radio programs. |

But that’s not all. In addition to training, we’re bringing your favorites back (and then some!)…

– Networking

– Vendors

– Networking Wall

– Case Study

– Deals

It all happens on Saturday. Hope to see you there! Save your spot by clicking the link below…