Understanding Real Estate Cycles + Best Advice for Each Cycle

Market cycles are timely, observable and predictable. But, as obvious as the signs are most real estate investors find it difficult navigating them.

Missing out on profit potentials and buying at the wrong time are some examples of the consequences of wrong timing.

There’s no national market cycle in real estate. Cycles are market and asset type specific. This is because various factors play significant roles that affect market trends in every particular niche.

Experienced real estate investors are experts at selecting niches for investment. They also build a team of niche-focused experts.

The driving factors that cause variation in niches are the economy, the law of demand, and supply.

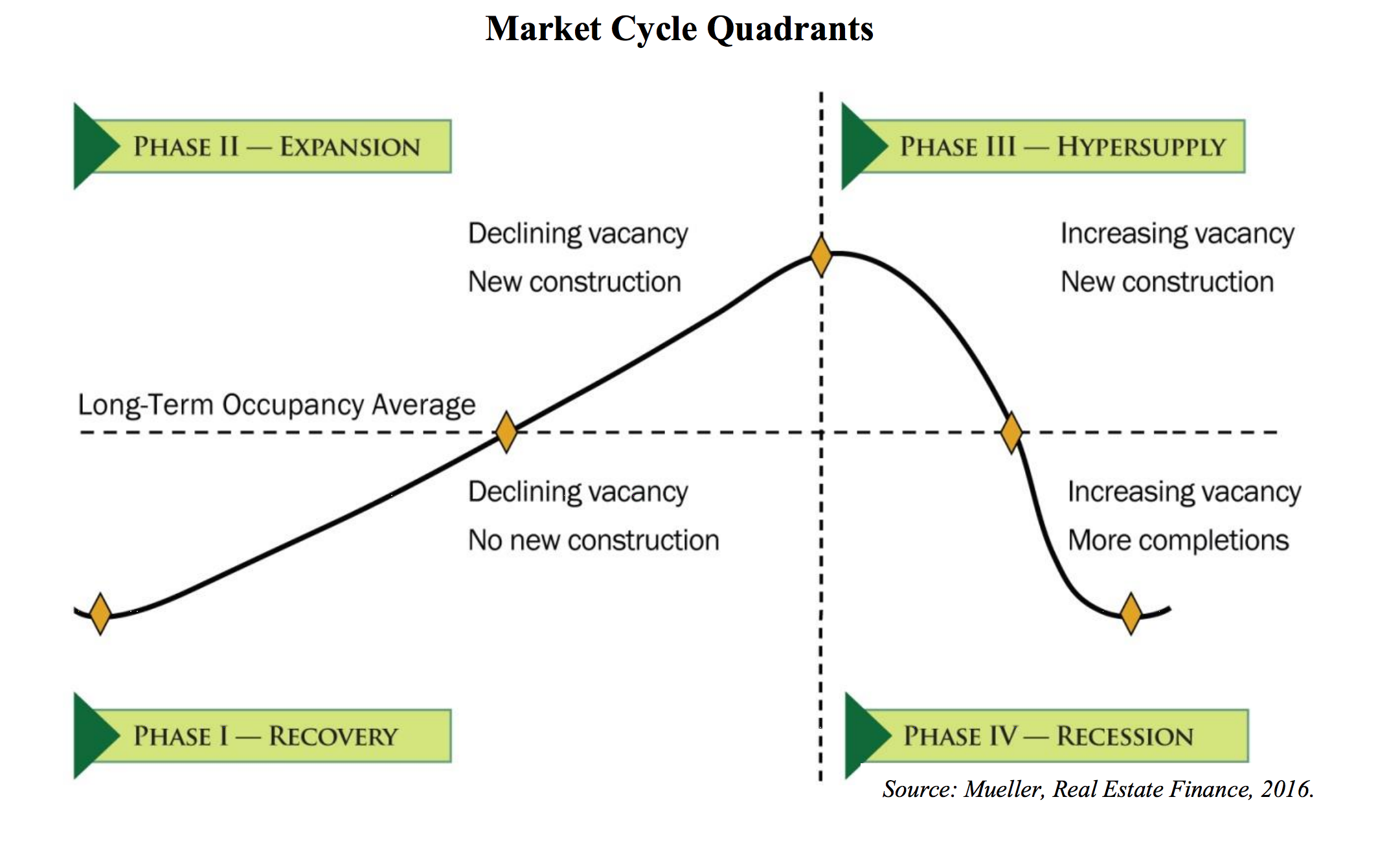

To some, this looks like a frequency sine curve. To others, it is a geometry quadrant with x and y-axes. In reality, the image above depicts what we call the ‘single real estate cycle’.

Real estate moves in patterns similar to the stock market and other market investment cycles.

Smart investors in every field monitor the market to know when best to throw in their hard earned money. Real estate is no exception.

Knowing pricing usually isn’t enough when it comes to real estate. There are principles and skills that guide successful real estate investors, and we’re going to cover some basics below.

Hard Assets Go Up In Value

I know a friend who lives in a home built in 1950. At the initial time of purchase before being flipped, it was bought for about $3k. It is possible that in 1950, the cost of building that home was $90. The same home now is valued at a couple of hundreds of thousands of dollars.

Real estate over time goes up in value. The reason is simple: Population drives the market and causes inflation and increased value over time. Real estate produces a frequency curve over an upward linear trend.

Although the trend is upward, real estate has high and low points in the market. A continuous progression that can be likened to the four seasons → spring, winter, summer, and fall.

The Holy Grail of Investing

One unique skill of successfully buying an investment property is the ability to invest successfully across all four phases of the cycle. This is more of a learned skill than an inborn skill.

Investors understand the trends and are able to achieve this by buying properties from motivated sellers at discounts. These are low enough to still make them profits even at the lowest points of the cycle.

Generally, these cycle phases movements affect a variety of factors, such as:

- Project planning

- Cost of equity

- Repair costs

- After repair values

- Exit strategies

- Profit margins

- Reinvestment strategies

4 Stages Of Real Estate Cycle

1: Recovery

The recovery phase is the start of the continuous wave pattern. Like every pattern, it is the ‘recovery’ from the end of the recession phase. Characteristics of this phase include:

- Declining vacancies

- Highly reduced leasing velocity

- Little or no building constructions

- Rental rate growth is negative (to flat)

The key thing to note…is that identifying the beginning of this phase may be difficult as the market still feels like it is in a recession.

2: Expansion

Like in a sine or frequency curve, the trend is upwards and swinging, especially in demand for space. Economically, things are beginning to look bright and back to normal levels. Characteristics of this phase include:

- Improved occupancy rates

- Increased rents

- New constructions

The key thing to note in this phase…is the high point at the crest of the wave is where supply and demand are in equilibrium.

3: Hyper supply

This is at the point of tipped excess in the supply and demand equilibrium. Characteristics of this phase include:

- More buildings than occupants

- Rising vacancies

- Falling demand for new developments

- Rent remains positive (although at declining levels)

The key thing to note…is that it is at the bubble point. There is a pullback in demand caused by a shift in the economy.

4: Recession

As with all patterns, this is the point where supply outweighs demands.

- Negative rent growth

- Rent reductions to retain tenants

- High vacancy rate

- More project completions

One thing to note here…is that at this point, buyers have the highest probability of acquiring assets from highly motivated sellers in distressed scenarios.

Is There A Crystal Ball For Perfect Predictions?

The answer is ‘No’.

This is because no two phases occur in equal periods. Any of the phases may be brief and transit very quickly to the next phase. Cycles can also vary depending on geography and asset class.

We encourage real estate newbies to research, work with a mentor and be vigilant to understand the nuances of each market and the best strategy to implement in each given situation.

But the best strategy still is to buy from motivated buyers at discounts to cushion any variation in market prices. MyHouseDeals has a huge database of such deals. We provide a platform for competitive deals in any market.

Finding such deals remains your best bet to make profits irrespective of any market cycle.